Why do institutional investors like large pensions and why do university endowments tend to outperform individual investors?

Large pensions and endowments have long advocated for owning alternative strategies—like private real estate—in their investment portfolios. Effective asset allocation is a strong driver of performance and risk management for these institutional investors. In addition, the diversification benefit of allocating capital to private real estate is a key reason this alternative asset class is so highly regarded.

Institutions commonly look to private real estate as an investment to contribute a balance of returns (through property price appreciation) and income (through tenant rent payments), which can help enhance a portfolio's risk-return profile. Many of these institutions are open to holding a significant percentage of portfolio assets in private real estate, as illustrated by Rice University, allocating nearly 14% of its $8.1 billion endowment to commercial real estate property.1

Favorable Outlook

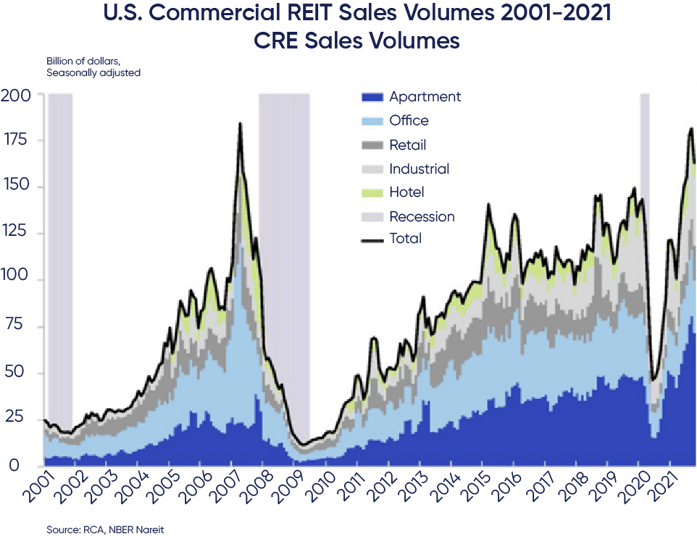

As reported by NAREIT, an industry organization representing the REIT sector of Commercial Real Estate (CRE), 2021 was a record year for many industry sectors, and 2022 appears to be well-positioned for similar growth.2

According to a recent outlook from private capital advisory firm Park Madison Partners, overall institutional allocations are expected to increase this year.3

“Given real estate’s diversification benefits, stable income stream, and strong return potential, we expect average institutional investor allocations will approach 11% in 2022.” - Park Madison Partners

The advisory firm highlights what it believes are the factors that will continue to drive growth in the private real estate industry.3

- Strong performance and bullish sentiment

- Low correlations to other asset classes

- High levels of current income in a low-interest-rate environment

- The asset class as a potential inflation hedge

- Capital market appetite for stabilized core assets

These forecasted characteristics are why many institutional investors will continue to use private real estate to enhance their investment portfolio’s risk-return profile.

Favorable Sectors

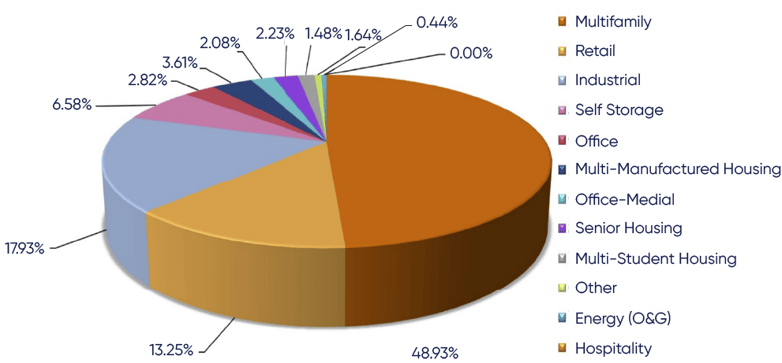

The private Commercial Real Estate market is a vast and essential segment of the U.S. economy. The industry is projected to generate $1.1 trillion4 in revenue in 2022. Institutional investors have access to a wide range of property types, as illustrated by industry research firm Mountain Dell in its 2021 year-end summary report.5

U.S. Securitized Private Real Estate

Sales by Asset Type 2021

The multifamily sector represented nearly 50% of overall securitized private real estate sales last year. There are many reasons why multifamily properties have been preferred among institutional investors over time and why this industry sector is well-positioned to outperform other real estate asset classes in 2022 and beyond.

Our next post will examine the factors driving the growth of multifamily investments. Finally, we will highlight how you can potentially benefit by investing in this private real estate sector.

In the interim, download our FREE ebook, A Potential Inflation Hedge for Today: Private Multifamily Real Estate.

You can also conveniently schedule a one-on-one meeting with me HERE.

Download Our Latest ebook!

1 https://www.perenews.com/why-rices-endowment-likes-being-overweighted-to-real-estate/

2 https://www.reit.com/news/blog/market-commentary/top-10-things-watch-commercial-real-estate-2022

3 https://www.perenews.com/look-ahead-2022-five-reasons-real-estate-allocations-will-rise-next-year/

4 https://www.ibisworld.com/industry-statistics/market-size/commercial-real-estate-united-states/

https://mf.freddiemac.com/docs/mf_securitization_investor-presentation.pdf

Topics: Insights, Inflation, Multifamily

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.

Real Estate Risk Disclosure | 1031 Risk Disclosure

• There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.;

• Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

• Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

• Potential for foreclosure – All financed real estate investments have potential for foreclosure;

• Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

•Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

• Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

• Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

BrokerCheck Information:

• Check the background of this firm on FINRA's BrokerCheck.

• Check the background of this investment professional on FINRA's BrokerCheck.