Investment advisors are turning to alternative investments to attempt to help stabilize and better balance client portfolios. If stock and bond market performance in the first quarter of 2022 is any measure, advisors might be prudent to make allocation changes sooner rather than later. Here are three reasons why:

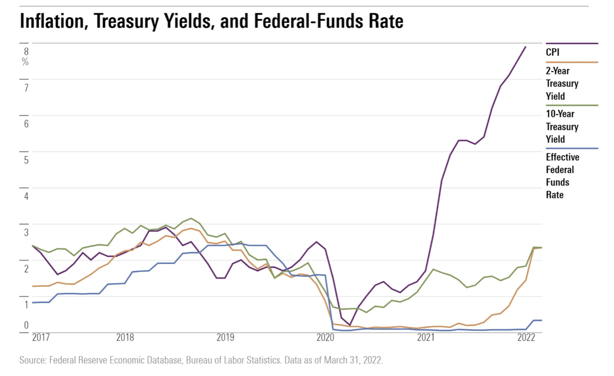

Insufficient Income

Advisors with income-oriented clients have endured several years of historically low interest rates. While yields have recently begun to inch upward, investment-grade rates remain inadequate to keep pace with inflation.

Lower for Longer

Source: morningstar.com

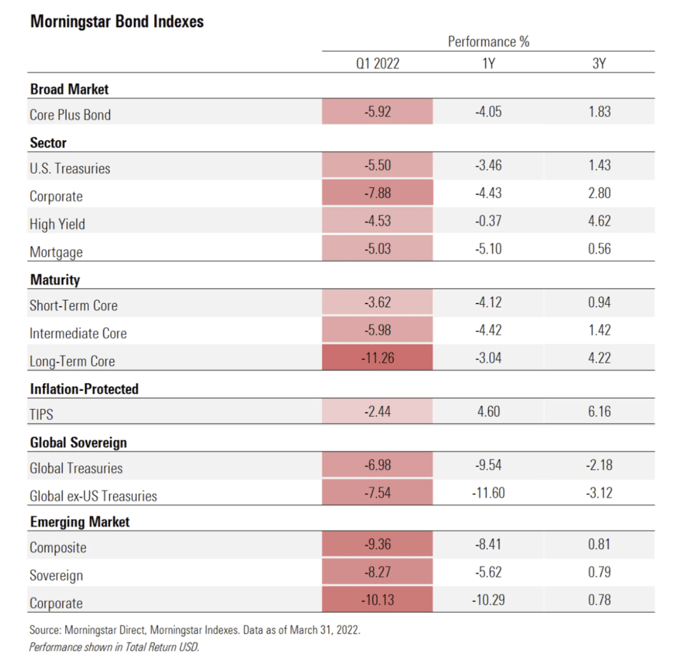

Bonds Get Rocked

As rates have increased, duration risk has come to the forefront for fixed-income investors. Bond prices suffered in the first quarter of 2022, driving the worst negative returns for fixed income indices in decades.

Sea of Red

Source: morningstar.com

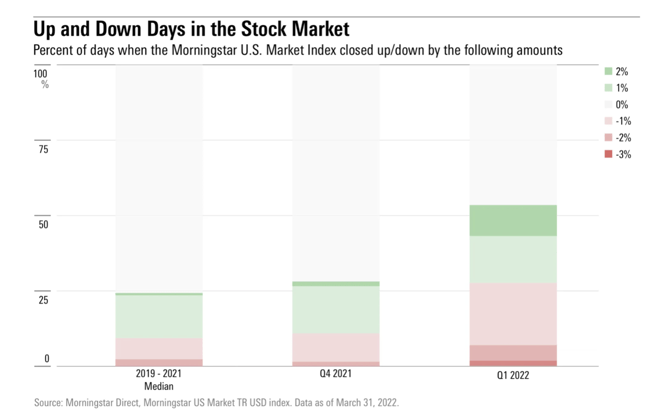

Volatility Accelerates

Large market swings accelerated in the first quarter of 2022. The frequency of down days in the equity markets more than doubled compared to recent years.

The New Normal?

Source: morningstar.com

Solving Portfolio Challenges with Private Real Estate

Private Real Estate investment strategies may help address performance challenges and volatility of traditional assets.

With a historically low correlation to stocks and bonds, Private Real Estate may help improve portfolio diversification. In addition, property owners can seek to raise rents to keep pace with rising costs, strengthening Private Real Estate’s case as an effective inflation hedge.

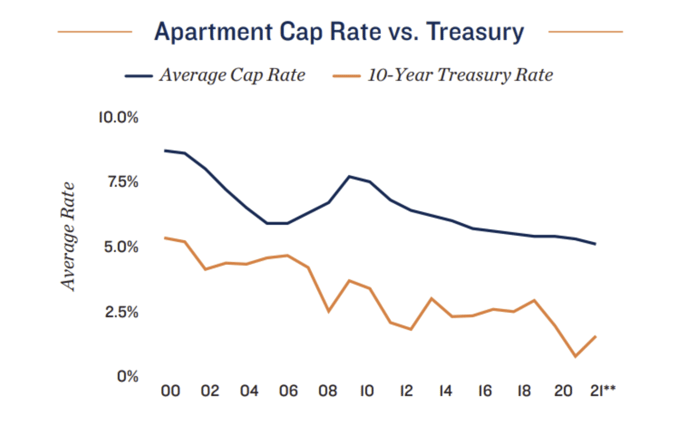

And among the big four commercial real estate asset classes—multifamily, retail, office, and industrial—multifamily remains a preferred asset class for many. Multifamily, as shown below, continues to serve as a vital alternative source of income potential for investors seeking greater yield.

Competitive Source of Income

Source: Marcus and Millichap

Despite the record year Multifamily Real Estate experienced in 2021, market fundamentals remain strong for the sector, as recently highlighted by Mark Renard, Executive Vice Chairman of Cushman and Wakefield:

“Multifamily development still represents one of the most compelling risk-adjusted return investments in the marketplace today.” Supply and demand fundamentals are in check, and [I] expect rental growth to continue and occupancy levels to keep tracking above historical trendlines.”

- Mark Renard, Executive Vice Chairman Cushman and Wakefield

Allocating to Multifamily Real Estate

As advisors consider portfolio allocation changes for clients to strive to help counter the effects of falling bond prices, heightened volatility, rising inflation, and stubbornly low yields, allocating to Private Multifamily Real Estate may be well worth consideration.

If you’d like to learn more about the multifamily investment option, download our FREE eBook, A Potential Inflation Hedge for Today: Private Multifamily Real Estate. You can also conveniently schedule a one-on-one meeting with me HERE.

Download Our Latest Ebook!

Topics: Insights, Inflation, Multifamily

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.

Real Estate Risk Disclosure | 1031 Risk Disclosure

• There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.;

• Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

• Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

• Potential for foreclosure – All financed real estate investments have potential for foreclosure;

• Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

•Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

• Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

• Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

BrokerCheck Information:

• Check the background of this firm on FINRA's BrokerCheck.

• Check the background of this investment professional on FINRA's BrokerCheck.