Reality stings. In 2021, Fed Chairman Jerome Powell believed that inflation would be transitory. Now, high and persistent inflation has become a real risk for investors that cannot be ignored. As a result, your clients are looking to you for answers. You have probably already begun adjusting client asset allocations and are considering additional hedging strategies to help protect their portfolios.

Remember that counseling clients can be as important as guiding their portfolios. You can be a valuable resource to your clients now by helping them understand the current state of inflation and what they may expect in the future. This post should help your efforts.

"Inflation is real, it's persistent, and it is large."

- February 15, 2020 Nasdaq.com1

The Numbers Tell the Story

The CPI (consumer price index) hit an annual 40-year high in January 2021, weighing in at 7.5%. And its cousin, the PPI (producer price index), followed suit a few weeks later with a month-over-month increase of 1%, nearly double what economists expected and the second-highest of all time. The PPI rose 9.7% for the 12-month period, just shy of a record.

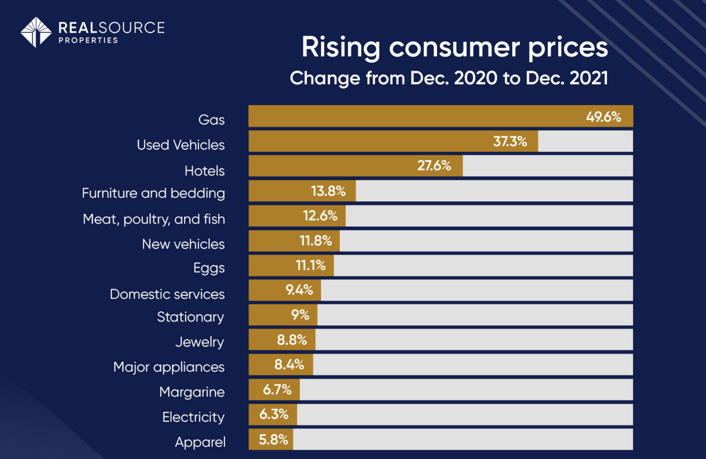

Together these two benchmarks highlight the seriousness of today's inflation. Your clients’ wallets are experiencing inflation’s impact daily through rising costs for products and services, as illustrated below.

Source: U.S. Labor Department; CNBC.com; Jan. 12, 20222

Missing the Mark

When Federal Reserve Chairman, Jerome Powell, referred to inflation as "transitory" in April 2021,3 there were reasons to believe he might be right. If the supply chain’s constraint could be solved and workers would fill the more than 10 million open positions, inflation might be reigned in.

Unfortunately, those events haven't occurred, and the Fed has reset expectations.

"There's a real risk now, we believe, I believe, that inflation may be more persistent."

- Fed Chairman Jerome Powell - Wall Street Journal, January 26, 2022 4

With this new perspective that inflation may be here for a while, the Fed could raise rates six or more times in 2022, according to some observers, up from two to three rate hikes forecast in the Fed’s own “dot plots” in 2021.

The Fed’s Strategy

The Fed's inflation-fighting strategy of raising rates is designed to increase the cost of borrowing and reward saving. The effect is to slow spending, reduce overheating in the economy, and ease inflation. Done correctly, the economy can grow at a more moderate, sustainable pace while giving consumers more spending power. In theory.

But the Fed faces headwinds, and its ability to reign in inflation may be limited not the least of which the is ongoing Russia-Ukraine situation and resulting economic impact. Changes in monetary policy take time to influence the economy. A couple of small rate hikes may have limited effect on consumer and corporate borrowing in the near term.

And while the Fed has successfully used rate increases to curb inflation in the past, this time may be different. The Fed is faced with the challenge of reducing its nearly $9 trillion balance sheet, which grew through Fed stimulus to help the world economy recover from the Covid-induced downturn of 2020 (and the financial crisis of more than a decade ago)and now the complexity of global sanctions and their impact on potential inflation.

So, while unprecedented uncertainty remains the word of the day for many investors looking for answers to the inflation puzzle, there are actionable steps you can take now to help protect your clients.

Time to Look at Hedging Strategies

With the likelihood that today's high inflation may persist for some time, it is well worth your time to assess potential inflation-hedging assets that may help protect your client portfolios. Gold, commodities, and TIPs are often viewed as effective hedges. We believe you should also consider private multifamily real estate, noted for its historic inflation sensitivity. We will discuss and compare these different options in a future blog article.

In the interim, if you would like to learn more about the private multifamily real estate, please contact us today for a consultation.

Download Our Latest Ebook!

Footnotes:

1https://www.nasdaq.com/articles/ppi-9.7-year-over-year-markets-up-on-russian-troop-drawdown

2https://www.cnbc.com/2022/01/12/consumer-prices-continued-to-rise-in-december-reaching-a-40-year-high.html

3https://www.cbsnews.com/news/interest-rates-inflation-federal-reserve-transitory/

4https://www.wsj.com/articles/jerome-powells-comments-over-the-past-year-show-mounting-inflation-concerns-11643236572

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.

Real Estate Risk Disclosure | 1031 Risk Disclosure

• There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.;

• Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

• Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

• Potential for foreclosure – All financed real estate investments have potential for foreclosure;

• Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

•Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

• Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

• Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

BrokerCheck Information:

• Check the background of this firm on FINRA's BrokerCheck.

• Check the background of this investment professional on FINRA's BrokerCheck.