According to economists and policymakers, stubborn and high inflation may be with us longer than expected. As a result, your client portfolios may need a fresh perspective.

Staying with your allocation models when inflation appears to be transitory is one thing. It’s quite another thing when you consider how stocks and bonds might perform against sustained high inflation.

Hold the Course?

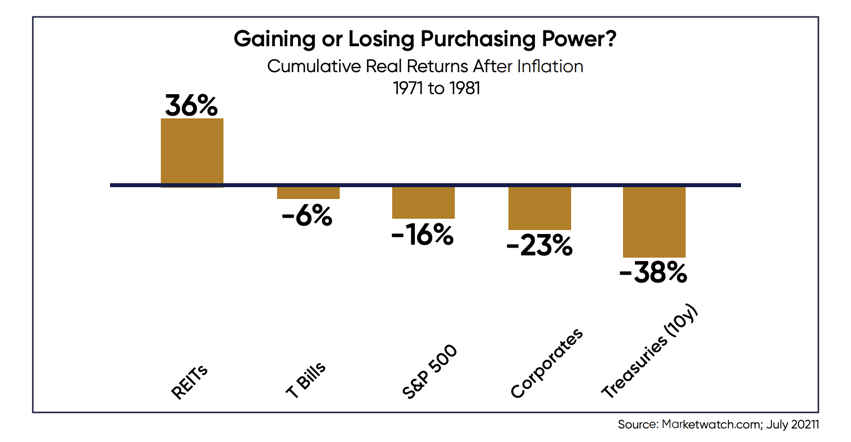

The following illustration shows how major asset classes performed during the Great Inflation of the ‘70s and early ‘80s. Pervasive negative real returns are a warning to advisors that a hold-the-course approach with traditional stocks and bonds could have severe consequences for clients.

Conventional Hedging Strategies

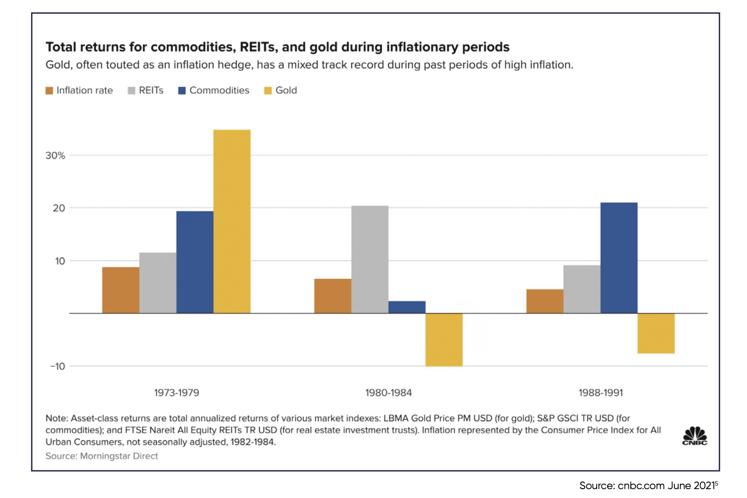

You may be inclined to turn to familiar hedging strategies like gold, commodities, TIPS, and public REITs as a way to help stabilize your client portfolios. Each performed effectively during specific inflationary periods. But there is no one-size-fits-all strategy.

For example, Treasury Inflation-Protected Securities (TIPS) are designed to keep pace with inflation and may be appropriate for conservative mandates or risk-averse clients. However, they will not beat inflation. On the other hand, gold and commodities may be more suitable for growth-oriented clients seeking to outpace inflation, but they can suffer significant drawdowns and exhibit high levels of volatility.

The distinctive performance characteristics of these asset classes mean you need to approach the allocation process thoughtfully, based on what type of inflationary environment may lie ahead.

Different Inflationary Episodes to Consider

Will we have high inflation for a short period or moderate inflation rate for an extended period? Of course, we can’t predict future outcomes, but the inflationary profile of each asset class matters, as you can see in this illustration:

Gold excelled during the Great Inflation but posted losses during the shorter inflationary periods. Commodities performed well during the inflationary episodes above, but haven’t always kept pace. In addition, they have exhibited high volatility and long periods of negative returns.

A Case for Real Estate

As represented by the FTSE NAREIT All Equity REIT index, real estate exhibited admirable hedging capabilities during these inflationary episodes, making a compelling case for this asset class. In fact, real estate can provide multiple potential benefits as a permanent position in client portfolios, not just when inflation spikes.

In our next post, we will highlight some of those advantages, and specifically, we will discuss why multifamily private real estate investments are of particular interest to investment advisors today.

To learn more about the private real estate option, download our free eBook, A Potential Inflation Hedge for Today: Private Multifamily Real Estate.

Download Our Latest Ebook!

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity LLC Member: FINRA/SIPC. Only available in states where Emerson Equity LLC is registered. Emerson Equity LLC is not affiliated with any other entities identified in this communication.

Real Estate Risk Disclosure | 1031 Risk Disclosure

• There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.;

• Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

• Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

• Potential for foreclosure – All financed real estate investments have potential for foreclosure;

• Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments.

•Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

• Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits

• Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

BrokerCheck Information:

• Check the background of this firm on FINRA's BrokerCheck.

• Check the background of this investment professional on FINRA's BrokerCheck.